As the Senate debates whether to repeal the Inflation Reduction Act (IRA), and with it clean energy tax credits, as part of the House’s proposed Big Beautiful Bill, we want to shed some more light on what a repeal could mean for solar and battery storage project economics. While this bill is only helping to create urgency with buyers who are already deploying onsite energy for cost, decarbonization, and resilience benefits, the proposed elimination raises important questions about the economic viability of distributed energy resources in a potentially shifting policy landscape.

Understanding the IRA’s Framework and Current Uncertainty

The IRA, passed in 2022 as a flagship initiative of the Biden administration, allocated approximately $370 billion toward clean energy technology, manufacturing, and innovation. The legislation was designed to accelerate private investment in clean energy, strengthen domestic supply chains, and enhance U.S. energy sovereignty while supporting ambitious climate goals:

- 100% carbon pollution-free electricity by 2035

- Around a 50% reduction in economy-wide greenhouse gases from 2005 levels by 2030

- Net-zero emissions economy-wide by 2050

The executive order’s immediate pause on the disbursement of federal grants and loans under both the IRA and the Infrastructure Investment and Jobs Act has created significant market uncertainty. However, it’s critical to note that the $270 billion in clean energy incentives—arguably the most impactful mechanism for distributed energy deployment—remain intact for now.

Current Energy Transition Momentum

Despite policy uncertainty, market fundamentals reveal the structural shift already underway in America’s energy landscape. In 2024, 96% of new U.S. power plant capacity was carbon-free:

- 60% solar

- 23% battery storage

- 10% wind

- 4% natural gas

- 2% nuclear

This composition of new generation capacity demonstrates that economic factors are now driving the energy transition independent of policy support.

Analyzing the Investment Tax Credit Impact

The Investment Tax Credit (ITC) represents the most significant IRA provision for distributed energy projects, offering a base 30% clean energy tax credit with potential bonuses:

- 10% Energy Community bonus (designated zones per IRS mapping)

- 10% Low-income community bonus (lottery-based allocation)

- 10% Domestic content bonus (using U.S.-manufactured components)

While the proposed bill creates uncertainty, there is notable bipartisan support for preserving energy tax credits and other elements of the IRA.

Economic Impact Analysis: California Case Study

To understand the real-world implications of potential ITC changes, we analyzed a commercial facility in California under different scenarios. The baseline system included:

- 789 kW solar PV system

- 1.5+ MWh battery energy storage

Scenario 1: Same System Configuration (30% ITC vs. 0% ITC)

When maintaining identical system specifications but removing the ITC:

- The net present value decreased by 85% (from $750,000 to $100,000)

- The internal rate of return (IRR) decreased by 27% (from 15% to 11%)

- The payback period increased by 45% (from 6+ years to 9+ years)

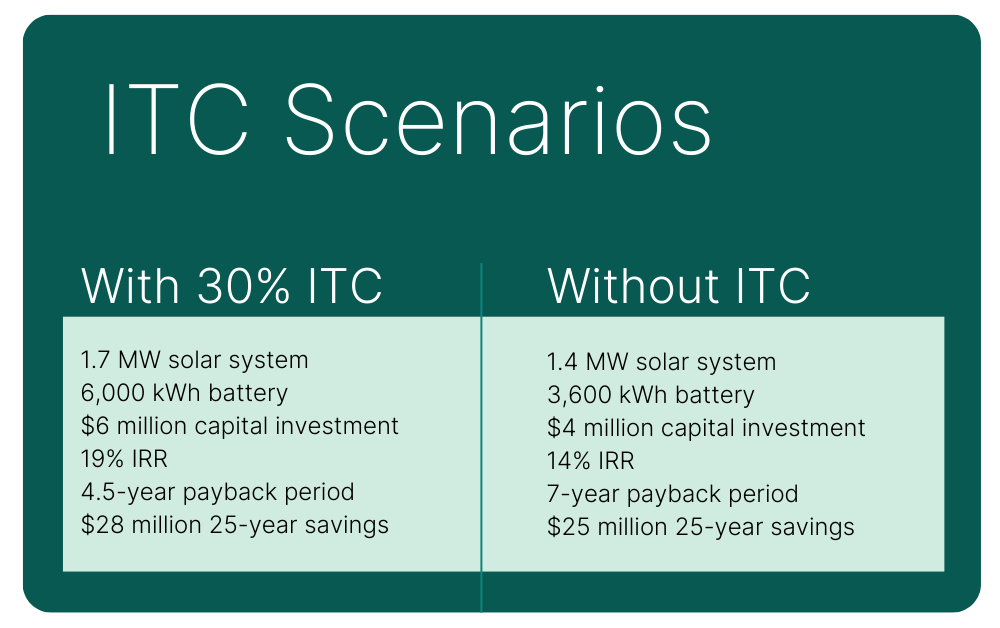

Scenario 2: Optimized System Configuration

When optimizing system design based on incentive availability:

This analysis reveals that while the absence of the ITC certainly impacts the economics, properly designed distributed energy systems remain economically viable and offer compelling long-term savings.

Strategic Implications for Stakeholders

The comparative analysis yields several important insights:

- System Optimization is Critical: Rather than maintaining predetermined system configurations regardless of incentive availability, continuous optimization based on current market conditions and available incentives yields superior economic outcomes.

- Economic Fundamentals Remain Sound: Even without tax incentives, optimized distributed energy systems can deliver 14% IRR with seven-year payback periods—metrics that remain attractive for many commercial and industrial investors.

- Market-Driven Transitions: The overwhelming dominance of carbon-free resources in new generation capacity suggests the energy transition is increasingly driven by fundamental economics rather than policy incentives.

- Regional Economic Benefits: With states like Nevada (2.4% of GDP), Arizona (1.8% of GDP), and Georgia (1.4%of GDP) experiencing significant economic benefits from IRA-related investments, there exists a strong economic rationale for maintaining investment incentives across political divides.

- Timing Considerations: For entities considering distributed energy investments, current uncertainty suggests accelerating implementation while tax credits remain available.

Looking Forward

The American Clean Power Association estimates that IRA provisions will spur $3.8 trillion in net investments in the U.S. economy, representing a 4x return on taxpayer investment. This macroeconomic impact creates powerful incentives for preserving at least some elements of the existing framework.

As policy uncertainty continues, three primary scenarios emerge:

- Status Quo: IRA provisions remain intact

- Reversion: Return to pre-IRA step-down structure (30% → 26% → eventual phase-out)

- Complete Repeal: Elimination of all IRA tax credits

Regardless of which scenario materializes, the fundamental economics of distributed energy resources have reached a maturity level where they can withstand policy volatility while continuing to deliver compelling economic returns. The key for stakeholders is maintaining flexibility in system design and continuously optimizing based on current market conditions.

For organizations considering distributed energy investments, this analysis suggests that while incentives significantly enhance returns, the underlying business case remains strong even in their absence—particularly when systems are properly designed and optimized for specific facility needs.