Solves the Challenge of Optimizing Onsite Energy Investment Strategy for Large Real Estate Portfolios

Energy and real estate leaders at large organizations face a complex question when presenting opportunities to finance leaders and capital allocation committees: is your recommendation the most efficient onsite energy capital deployment plan to maximize financial returns and minimize net investment? Traditional project-by-project approaches or bundling large groups of projects with one developer misses the synergies and significant unrealized value of a portfolio-wide approach.

VECKTA’s newest platform offering, VECKTA Strategy, directly addresses this challenge with dynamic portfolio optimization. It solves the scale-up challenge facing organizations struggling to deploy onsite energy systems across hundreds or thousands of facilities. By transforming a seemingly insurmountable capital requirement into a manageable program, VECKTA Strategy enables the systematic deployment of many projects over multi-year horizons.

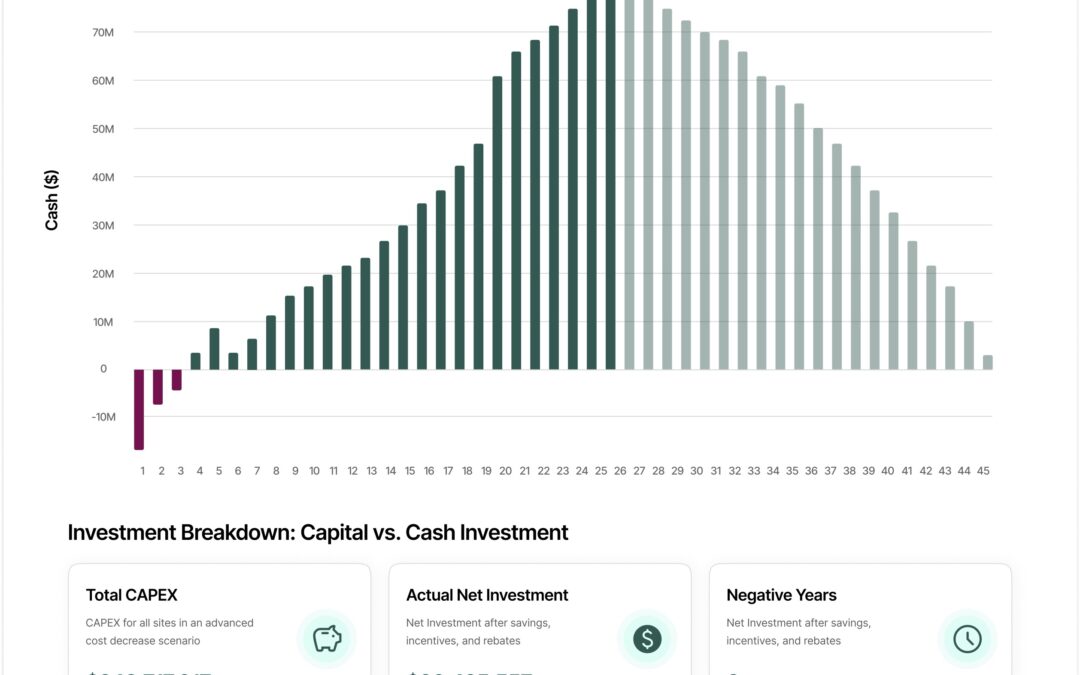

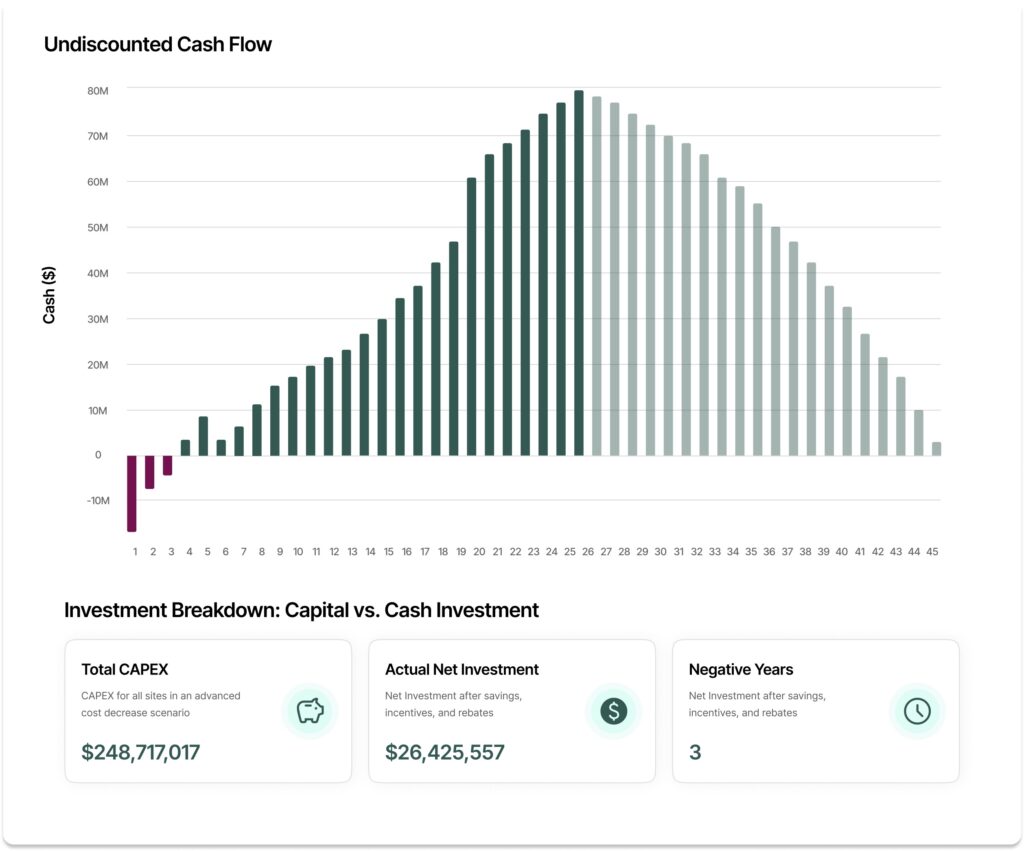

VECKTA Strategy reveals a critical financial insight that is difficult to model by manual one-off analysis: the compounding effect of reinvested energy savings dramatically reduces net investment requirements. Net investments across VECKTA customers’ portfolios have been between 11% and 32% of the total project CAPEX across all viable sites in the portfolio.

“This transformation in capital efficiency creates unprecedented economic opportunities. We’ve seen that across a large portfolio, you can save in excess of a billion dollars over 20 years by deploying these onsite energy systems strategically, with a capital investment of between $100 and $150 million and your net cash investment being $20 million or less,” said VECKTA co-founder Gareth Evans.

VECKTA Strategy: Core Capabilities

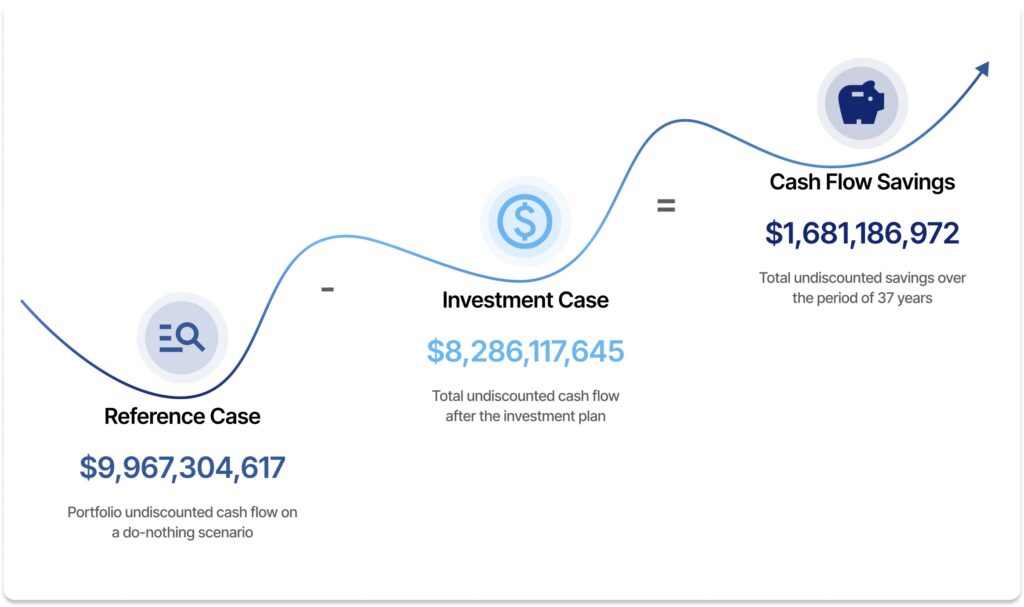

VECKTA Strategy transforms onsite energy deployment for organizations with large portfolios by establishing a comprehensive investment roadmap that sequences projects optimally, determines the ideal financing structure for each project, dynamically adjusts as market conditions change, and maximizes financial returns.

“By optimizing the sequence of project deployment, you can re-invest the energy savings and tax benefits into subsequent projects and maximize overall benefits. Your cash requirements are going to be a fraction of what you thought they would be. We’ve seen cases where the net investment is only 20% of the entire capex initially projected,” said Felipe Sarubbi, VECKTA Co-founder and SVP of Product.

VECKTA Strategy leverages advanced optimization algorithms that analyze thousands of possible deployment sequences and financing combinations against budget, resourcing, time horizons, and other constraints. The tool processes gigabytes of site-specific data to create dynamic, adaptive roadmaps that respond instantly to changing assumptions or market conditions. Finance teams can be confident in “greenlighting” projects, as VECKTA’s models adhere to federal financial reporting standards, ensuring outputs align with corporate finance requirements and capital allocation processes.

The VECKTA Strategy module enables organizations to:

- Sequence investments strategically across facilities based on cash flows and net present value, emission reductions, and operational priorities.

- Optimize financing structures by determining which projects should be self-financed, debt-financed, or structured as PPAs.

- Project comprehensive cash flows show how early project savings fund subsequent deployments.

- Align deployment timing with budget constraints, sustainability targets, and operational needs.

- Adapt dynamically to changing market conditions, utility rates, and financing opportunities.

VECKTA Strategy bridges organizational silos by providing tailored analytics for different stakeholders:

- Finance teams: Gain portfolio-wide project roll-out visibility with detailed NPV, IRR, and cash flows.

- Operations leaders: receive deployment schedules aligned with facility priorities and site-specific requirements.

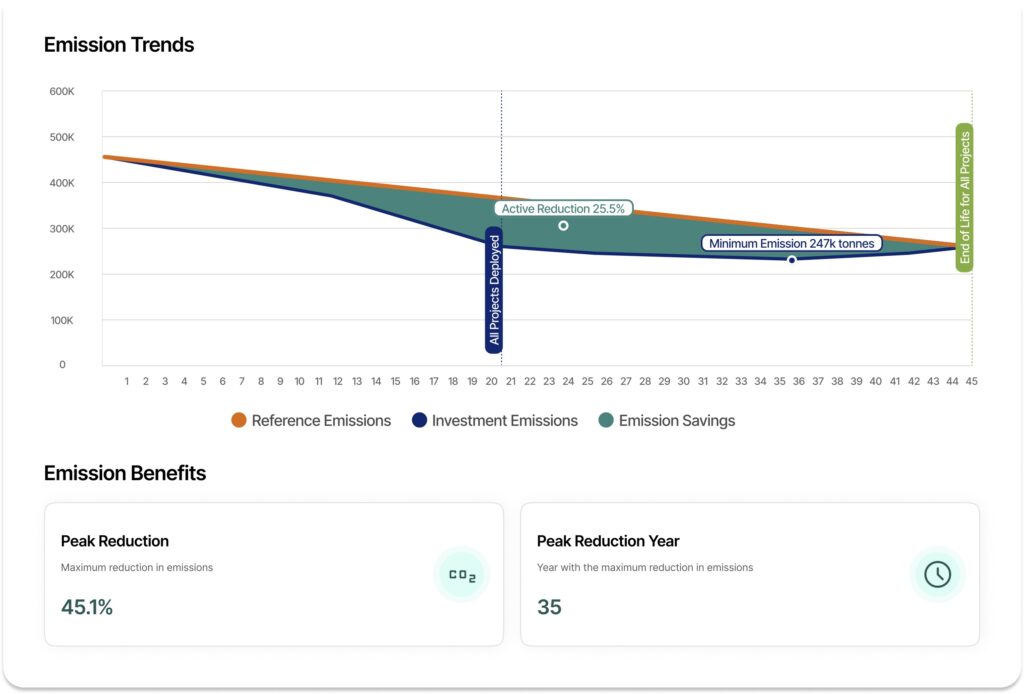

- Sustainability officers: obtain clear pathways to emissions reduction targets with financial justification.

- Executive leadership: access comprehensive risk-adjusted cash flow forecasts for confident capital allocation.

Strategic Imperative

For organizations seeking to control energy costs, enhance resilience, and advance sustainability goals across large portfolios, VECKTA Strategy provides the analytical foundation for confident, data-driven onsite energy investment decisions. The platform transforms fragmented facility-by-facility approaches into cohesive portfolio strategies that maximize savings while minimizing capital requirements.