The Big Beautiful Bill's Impact on Onsite Energy

Business cases improve in the short term. Act now.

Webinar Recording

On July 4, President Donald Trump signed into law the Big Beautiful Bill, a massive spending and budget bill that made changes to tax credits and rules around clean energy technologies. Find out how these new rules impact onsite energy project economics and get our guidance for maximizing available incentives and setting a profitable, resilient and sustainable energy strategy.

What we cover:

- Updates to tax credits for clean energy projects

- Changes to asset depreciation

- Project-level and portfolio-wide economic analyses for solar + battery storage projects

- Deployment timeline considerations

- Guidance on progressing your energy transition plans

The Start of a New Phase in Distributed Generation Deployment

Perspectives from VECKTA CEO, Gareth Evans, on how businesses should be thinking about the changes the One Big Beautiful Bill brings and the opportunity to drive profitable energy solutions forward.

The “Big Beautiful Bill” just passed in the U.S., and if you read all the press and listen to some of the noise in the market, you’d think it’s time to throw in the towel. Race over!

But that’s not the case.

This isn’t the end. It’s the start of a new phase of the race. Sure, the terrain just changed. Incentives are shifting. Some provisions got trimmed. The confidence of some is knocked. But just like Alpecin–Deceuninck at the Tour, we’ve seen this all before, and change is the only constant.

If you had a singular vision and a static plan, you would be impacted. But if you’ve been building your strategy with eyes open or are open to adapting, you’re in a great position to lead. That’s why I’m still incredibly bullish. Here’s why:

Inevitable Trajectory

The pain points are becoming undeniable. Energy isn’t a nice-to-have; it’s the foundation of your business. As discussed in this article, incentives are great, but they are no longer the metric that makes projects viable or not. If your costs are volatile, your margins are at risk. If your power isn’t reliable, your operations are exposed. If your sources aren’t clean, your stakeholders will push back. The idea that you can outsource your energy strategy and hope for the best? That era is over.

Urgency

The revised landscape creates urgency. For years, companies could afford to wait. Incentives weren’t going anywhere, so there wasn’t much reason to move fast. But as pain points mount, that window is now narrowing. Instead of having tax credits for solar through 2035, they are now available for projects that begin construction within one year of enactment (by 7/4/2026) if placed in service within 4 years, OR begin construction after 7/4/26, they must be put into service by 12/31/2027 to qualify. Businesses that act today will lock in long-term value that is financial, operational, and reputational. Waiting just got expensive.

Innovation

The incentives that matter most are still intact. Battery storage in particular remains a massive opportunity. It’s not just about backup power, it’s about unlocking stacked value: load shifting, demand reduction, grid services, and more. Battery tax credits are protected through 2033. They will increasingly be a key component of onsite energy systems moving forward, where it makes economic and operational sense.

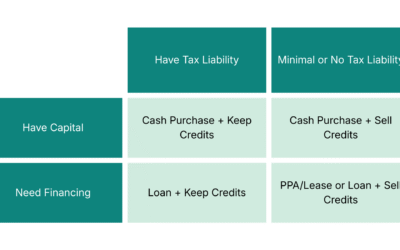

Capital Availability

Capital is no longer a constraint for this market; there is dry powder available to companies who want to secure financing for their projects. That said, one major and very positive update is the reinstatement of 100% bonus depreciation, up from 40% in 2025 and previously set to phase out entirely by 2027. Being able to depreciate onsite energy equipment by 100% in the first year makes the economics of projects even more compelling. Done right, behind-the-meter systems aren’t a sunk cost; they’re an asset, and access to capital isn’t a barrier to action.

Process Efficiency – The soft costs that have plagued our industry, such as high origination costs, unclear processes, fragmented solutions, long procurement timelines, interconnection delays, unique contracts for every project, and more, are being streamlined. This, combined with ongoing equipment price reductions, increasing energy costs, outage impacts, and stakeholder pressure (direct penalties, regulatory, contractual, or brand), will more than ensure onsite energy projects are economically viable and extremely valuable vs passive energy consumption from the grid.

Frequently Asked Questions

If a solar project is completed by 12/31/2025, does the 30% base ITC apply?

Yes, if a solar project is completed by the end of 2025, it qualifies for the 30% ITC and any additional qualifying adders.

When must a project be completed to qualify for bonus depreciation?

The “One Big Beautiful Bill” restores and makes permanent the 100% bonus depreciation provision first introduced in the 2017 Tax Cuts and Jobs Act, allowing companies to immediately write off the full cost of qualifying equipment in the year it is placed in service. Specifically:

100% bonus depreciation applies to qualified property acquired and placed in service after January 19, 2025, with no scheduled phase-down.

This means businesses can deduct the entire purchase price of eligible equipment and property in the first year, rather than depreciating it over several years.

What are the material cost ratio limits for PFEs?

Until further guidance is given, the “material assistance cost ratios” are:

- Begin construction in 2025 = no restrictions

- Begin construction in 2026 = above 40% (solar) and 55% (storage) from non PFEs

- Begin construction in 2027 = above 45% (solar) and 60% (storage) from non PFEs

More Resources

Top Moment from 2026 Energy Predictions and 2025 Reflections with Bill Nussey

Is the massive AI data center build-out solving tomorrow’s problems or creating new ones? In this highlight episode, we explore one of the most pressing questions at the intersection of energy, technology, and infrastructure: whether today’s AI-driven demand for...

Ep 107: Market Maturation Moment as Behind-the-Meter Becomes Real Infrastructure

Is the behind-the-meter energy market finally growing up? In this episode, we break down a major shift happening across the U.S. as states like New Mexico, Oregon, Colorado, and Illinois move from simply allowing onsite energy systems to regulating how they perform....

Top Moment from Onsite Energy as a Profit Center for Commercial Real Estate Owners – Our Talk with Brendan Wallace, Fifth Wall CEO and CIO

What will it really take to decarbonize real estate and who is going to pay for it? In this highlight episode, Brendan Wallace breaks down the staggering $18 trillion challenge of decarbonizing U.S. buildings and why the real estate industry must fundamentally...

Selling Solar Tax Credits: Why Sell, When to Sell and Navigating the Process

A conversation with Erik Underwood of Basis Climate and James Coombes of Conductor Solar When the Inflation Reduction Act passed in 2022, Erik Underwood and his co-founder read the legislation, saw the part about tax credit transferability, looked at each other, and...

Ep 106: Selling Solar Tax Credits: Pricing, Timing, and Deal Structuring with Basis Climate and Conductor Solar

What if your renewable energy tax credits could turn into immediate cash instead of sitting on your balance sheet for years? In this episode, Erik Underwood, Co-Founder and CEO of Basis Climate, and James Coombes, VP of Business Development at Conductor Solar, break...

Top Moment from Power Market Dynamics with Author and Analyst Meredith Angwin

What if the grid reliability forecasts we trust are built on assumptions that don’t hold up in the real world? In this highlight episode, we explore one of the most overlooked vulnerabilities in modern energy systems: the gap between installed natural gas...