Navigating the New Clean Energy Tax Credit Rules

If you’re considering solar in the next 3-5 years, the time to act is now. Maximize ITC benefits and avoid FEOC compliance pitfalls.

What to Know

Critical action deadline: December 31, 2025

Spend at least 5% (more on this below) of your project cost before year-end and you can:

- Avoid Foreign Entity of Concern (FEOC) compliance entirely

- Sidestep significant legal and documentation costs

- Lock in ITC eligibility for projects <1.5MW

- Buy yourself 4 years to place the project in service

Other critical deadlines at a glance

July 4, 2026: Begin construction (5% safe harbor for projects <1.5MW ac or begin physical work for projects >1.5MW ac) to secure 4-year window to place in service

December 31, 2027: If you don’t meet the critera above before July 4, 2026, place the project in service by this date regardless of size

Safe harbor guidance

Safe harbor can be achieved with at least 5% of total project cost paid and procured before July 4, 2026 (to secure 2025 ITC eligibility for <1.5MW size projects) and before Dec 31, 2025 (to avoid FEOC compliance burdens for any size project).

- Spend slightly more than 5% to be fully “audit-proof,” and protect the project from non-compliance if the total project value increase after contract is signed.

- Funds must be used for actual procurement (typically solar modules), not just for signing contracts.

- Modules are procured and stored at approved warehouses within 105 days of payment. The warehousing has to be paid for by the developer or owner, but does not have to be their own warehouse. Deposits must be non-refundable, and storage fees covered by the developer.

- Each procurement should be fully traceable through paid purchase orders, warehouse tracking, and a clear chain of custody to ensure IRS audit compliance.

Supply chain diligence

If you can’t avoid FEOC, ensure your equipment suppliers provide proper documentation and warranties on the origin of components. This is increasingly important for institutional tax equity.

Contractual protections are essential

With EPC backlogs growing, include liquidated damages and timeline guarantees in your contracts to avoid being deprioritized for larger projects.

Determine priority projects

Map out all projects planned for 2025-2030 and their sizes. Determine which projects are most impacted if they don’t leverage the ITC. For the most impacted projects greater than 1.5 MW ac, prioritize incurring 5% of costs by 12/31/2025 to avoid FEOC compliance and begin physical work by 7/4/2026. For projects smaller than 1.5 MW ac, prioritize incurring the 5% cost to avoid FEOC and secure the four-year timeline to place in service.

Webinar Replay

We just wrapped up an essential conversation between VECKTA Co-Founder Dan Roberts and Marc Palmer, CEO of Conductor Solar, breaking down what the new tax landscape really means for your projects. The recording is ready, and there’s one date you need to circle: December 31, 2025.

In this 35-minute webinar, you’ll learn about:

• Physical work test vs. 5% safe harbor: which applies to your project?

• How to navigate FEOC requirements (or avoid them altogether)

• Why EPC backlogs are building—and what it means for your timeline

• Contractual protections you need when locking in your deployment partner

More Resources

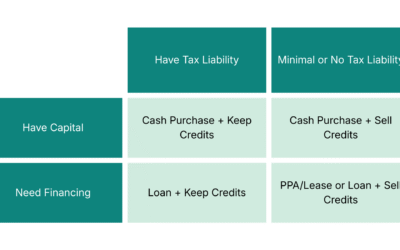

Selling Solar Tax Credits: Why Sell, When to Sell and Navigating the Process

A conversation with Erik Underwood of Basis Climate and James Coombes of Conductor Solar When the Inflation Reduction Act passed in 2022, Erik Underwood and his co-founder read the legislation, saw the part about tax credit transferability, looked at each other, and...

Ep 106: Selling Solar Tax Credits: Pricing, Timing, and Deal Structuring with Basis Climate and Conductor Solar

What if your renewable energy tax credits could turn into immediate cash instead of sitting on your balance sheet for years? In this episode, Erik Underwood, Co-Founder and CEO of Basis Climate, and James Coombes, VP of Business Development at Conductor Solar, break...

Top Moment from Power Market Dynamics with Author and Analyst Meredith Angwin

What if the grid reliability forecasts we trust are built on assumptions that don’t hold up in the real world? In this highlight episode, we explore one of the most overlooked vulnerabilities in modern energy systems: the gap between installed natural gas...

Ep 105: How Leading Commercial Real Estate Owners Are Building Million-Dollar Revenue Streams from Solar and Energy Storage

What does it actually look like when a multifamily owner “becomes a utility”? In this episode, you’ll learn how developers and asset managers are using on-site solar and virtual net metering to create real value, not just sustainability headlines. We break down how a...

Top Moment from The Immense Savings Potential of Energy Efficiency with Josh Bachman of Cascade Energy

In this highlight episode, Josh Bachman of Cascade Energy breaks down why energy efficiency isn’t just a sustainability or decarbonization conversation—it’s a serious financial opportunity that most organizations are overlooking. You’ll learn how energy waste shows...

Ep 104: Understanding the ITC Phase-Out: Deadlines, Requirements, and Strategy

What if waiting just a few more months could cost your company millions in lost tax credits? As 2026 begins, we break down why the Investment Tax Credit (ITC) has become one of the most urgent financial opportunities facing commercial energy projects today. With...