Insights from our recent webinar about monetizing solar and storage featuring Regency Centers, Kire Builders, and Ivy Energy.

For years, commercial real estate owners interested in onsite solar have defaulted to the simplest path: lease your roof to a third-party developer, collect steady rent, and avoid operational complexity. But as utility rates climb and renewable energy technology matures, forward-thinking CRE operators are discovering that this “easy button” approach leaves significant value on the table.

In our recent webinar, “Commercial Models for Onsite Solar in Commercial Real Estate,” we brought together two industry leaders who’ve deployed solar across their portfolios and two enabling technologies and advisory teams, including us. What emerged was a masterclass in how to think strategically about onsite energy as a revenue-generating asset class, not just a sustainability checkbox.

The Evolution Beyond Roof Leases

Mark Peternell, VP of Sustainability at Regency Centers, has been deploying solar across the company’s 480-property portfolio since 2010. His perspective is instructive: while roof leases have their place, they’re often the least valuable long-term option.

“Traditionally, solar roof leases require a long-term commitment. Ten years ago, it was often 25 years. Today, it’s maybe 15 to 20 years,” Mark explained. “That’s a really long time to have an insignificant tenant from an NOI standpoint that encumbers the flexibility of how we can manage that asset.”

Instead, Regency evaluated its options and chose to deploy its own capital, owning and operating renewable energy assets directly. The reason? The projects consistently deliver returns equal to or better than traditional real estate development projects—while also advancing decarbonization goals.

The Multifamily Value Creation Story

For multifamily operators, the value proposition can be even more compelling. Stephan Gaspar, Development Manager at KIRE Builders, shared results from their 92-unit community in National City, California, that illuminate the opportunity:

- System size: 279 kW (about 3 kW per unit)

- Unlevered CapEx: $8,000 per unit

- Annual NOI generated: $110 per unit per month ($121,000 annually)

- Yield on cost: 16.4% (compared to market cap rates of 5-5.25%)

- Value created: $26,000 per unit on an $8,000 investment—a 3.25x unlevered multiple

“We joke internally that we should become a utility company,” Stephan said. “It’s much more profitable than building multifamily.”

The secret? KIRE uses Virtual Net Energy Metering (VNEM), a California program that allows them to deploy renewables onsite, interconnect in front of the meter, and allocate credits to any benefiting meter under the same ownership. This creates what Steven describes as “an onsite community solar slash mini microgrid.”

Four Commercial Models Worth Considering

The webinar outlined four primary commercial structures for CRE owners to consider:

1. Self-Consumption (Common Area Load)

Deploy solar to offset your own electricity costs—parking lot lighting, common areas, HVAC systems. This works best for properties with substantial landlord-controlled loads, like enclosed malls, mixed-use developments, or properties with parking garages.

Best for: Properties with significant common area electrical loads

2. Tenant Power Purchase Agreements (PPAs)

Install systems and sell the energy directly to anchor tenants at rates discounted from utility prices. Regency has done this successfully with major retailers, though Mark notes the sales cycle can be long and not all retailers have the expertise or personnel to evaluate these deals efficiently.

Best for: Properties with creditworthy, long-term anchor tenants

3. Front-of-the-Meter / Feed-in Tariffs

This is Regency’s preferred model. Build systems that interconnect directly with the utility, sign 20-year power purchase agreements at predetermined rates, and avoid tenant involvement entirely.

“We love it because it’s less complicated—easier to sign up a utility than one of our retailers,” Mark explained. “And it’s less risk because they’re signing a 20-year contract, whereas our retailers won’t commit to buy energy beyond the term of their lease.”

Best for: Markets with favorable feed-in tariffs (Massachusetts, Connecticut) or community solar programs

4. Virtual Net Metering (Multifamily)

For multifamily operators in states offering VNEM (primarily California), this model allows aggregation of multiple meters under a single solar system, with sophisticated software tracking production and allocating credits to residents.

Logan Carter, Co-Founder and Chief Commercial Officer of Ivy Energy, emphasized the platform’s transparency: “We give tenants real-time visibility into what they consume from the grid, what they’re consuming from solar, when there’s live solar generation, how credits are being allocated—it’s a very transparent platform that influences tenants to consume onsite solar.”

Best for: Multifamily properties in VNEM-eligible markets, particularly California

The Financial Fundamentals That Make This Work

What makes these owner-operated models so attractive isn’t just current economics—it’s the widening arbitrage opportunity as utility rates escalate.

Logan put it succinctly: “When you invest in renewable energy, you invest today and your payback period is over that 15, 20, or 25-year warranty life. You create a levelized cost to produce power—you’re producing power at seven or eight cents, and in California we’re billing that up to 33 cents right now. In a few years, that’s going to be 40 cents and then 45 cents. It’s just a delta that continues to grow.”

For KIRE’s multifamily properties, this translates to passing through a 10% discount to residents (generating goodwill and retention) while capturing substantial NOI that compounds as utility rates rise. And for Regency’s portfolio, it’s enabled them to generate nearly 30% of their direct electricity consumption from onsite renewables—not through RECs, but actual onsite generation.

Navigating the REIT Tax Structure

One of the most valuable portions of the webinar addressed how REITs can own and operate solar systems while monetizing Investment Tax Credits (ITC) despite not paying income taxes.

Mark explained Regency’s structure: “We own and operate [solar systems] in our TRS vehicle—our taxable REIT subsidiary. Therefore, we can utilize the solar tax credits to offset any tax liability in that vehicle. That special purpose entity then turns around and signs a roof lease with the underlying property LLC, so that a percentage of the revenue the solar entity is getting is paid back to the property as roof rent—which makes that good income, because it’s rental income and not income from the sale of energy.”

This creative structuring allows REITs to:

- Monetize the 30% federal ITC (stepping down to 26% in 2033, then 22% in 2034)

- Avoid “bad income” thresholds

- Maintain flexibility in asset management

- Capture long-term revenue from energy generation

Where the Economics Work Best

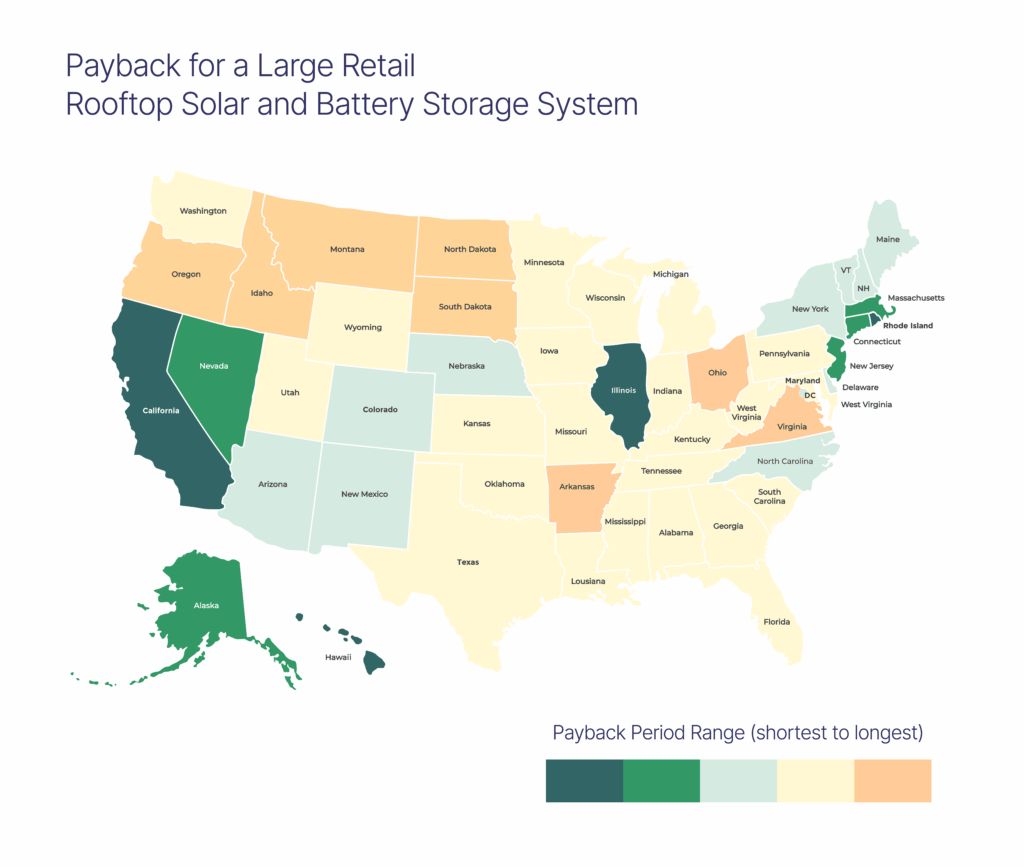

While every market is different, Dan Roberts, Co-Founder and SVP of Sales at VECKTA, shared a heat map showing where onsite solar delivers the strongest returns. Not surprisingly, the darkest green areas align with high utility rates:

- Tier 1: California, Hawaii, New England states, New York

- Tier 2: Illinois (strong state incentives), parts of Arizona and Nevada

- Tier 3: Mid-Atlantic, parts of Texas and Colorado

But Logan added an important caveat: “That map shows the carrot—the value of avoided utility costs. But you also need to analyze the sticks.” He’s referring to:

- Scope 3 emissions mandates for REITs

- Local requirements (Local Law 97 in NYC, Energize Denver)

- Building Performance Standards rolling out in multiple cities

- California Title 24 requirements for new construction

“When we gather a pro forma, we package the carrots and sticks together, and they really improve the returns,” Logan said.

Best Practices from the Field

Both Mark and Stephan emphasized several critical success factors:

Start with trust-building: Mark’s first solar project was in 2010, but it took several more successful projects to build internal support across finance, legal, and operations teams. “It wasn’t one project for us—it was several to continue building a successful track record and understanding,” he noted.

Partner strategically: Both highlighted the importance of working with experienced advisors who understand solar contracts, production guarantees, and O&M agreements. “If you haven’t done solar before, partnering with somebody like VECKTA could be useful because the things in a solar contract are very different,” Mark advised.

Engage early in design: For new construction, Stephan stressed the importance of submitting solar plans alongside building plans rather than treating solar as a deferred submittal—despite cities initially resisting this approach.

Plan for the long term: These aren’t short-term plays. Mark noted that Regency’s older PPAs with fixed escalators now look like missed opportunities as utility rates have climbed faster than anticipated. “Those tenants are seeing real meaningful savings as a result of power purchase agreements signed 7, 8, 10, 15 years ago,” he reflected.

Monitor and optimize: Stephan shared that KIRE actively evaluates their allocation percentages in VNEM systems, adjusting based on actual consumption data to ensure optimal credit distribution across different unit types.

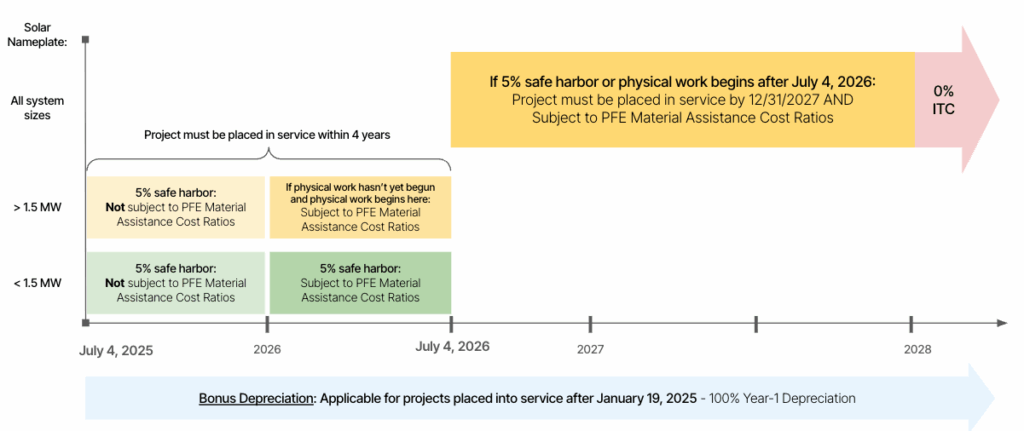

The Urgency Factor: Tax Credit Sunset

While the conversation focused on operational models, Dan reminded attendees of the ticking clock on federal tax credits. The 30% ITC is in the process of sunsetting, stepping down over the next decade. “There’s still plenty of time on commercial projects to drive the value of these tax credits as we move into 2026 and beyond,” Dan noted, “but it’s worth noting safe harboring projects between now and early July of next year, and getting projects to PTO by the end of 2027.”

Moving Beyond the Default

The message from this webinar is that roof leases may be simple and still provide returns, but they’re likely the least valuable long-term option for CRE owners serious about onsite energy. Whether you’re managing open-air shopping centers, multifamily communities, or mixed-use developments, there are commercial structures that allow you to capture more value, maintain more control, and build revenue streams that compound as utility rates rise.

As Regency’s portfolio demonstrates—30 systems energized, 9 more under construction, and a pipeline of another dozen targeting 30% of portfolio consumption from onsite renewables—this isn’t a niche strategy. It’s becoming table stakes for operators who view their real estate as platforms for energy generation, not just space rental.

The question isn’t whether onsite solar makes sense for your portfolio. It’s whether you’ll choose the path that maximizes long-term value—or settle for the easy button that someone else profits from.